- Why Mining Matters

- Jobs

- Safety

- Environment & Operations

- FAQ

- Links

- Fun Stuff

You are here

Thomas J. Brown

BESCO’s Pension

Dan McIsaac and Jim Taylor

Tius Tutty

Wilson Beaton

Aerotech Connector

Henry Swift

1885 Vale Tour

Douglas Slope Explosion

John Angus MacNeil and WWI

Florence Colliery

Joseph Walton

James Lennon

James Hamilton

1918 Allan Mine Disaster

Robert Boutilier’s Luck

Springhill’s John Anderson

Plight of Youth in 1931

Miners’ Wives Praised

Dominion No. 1B in 1931

Allan Shaft, 1931

Private Maceachern

Husseys Prospectus

William Routledge

Swell Factor in Reclamation

Gowrie Mine

River Hebert

Joggins 1904 Fire

Port Hood 1911 Flood

Lamp Cabin Memorial Park

Drummond 1873 Disaster

1872 Accidents

Springhill’s Novaco Mine

1860's Accident

New Glasgow's Linacy Mine

1913 Drummond Fires

1908 Princess Fire

Albion Mines 1913 Fire

DOSCO Miner

Cape Breton's TNT

The McCormick and Turner families

Payday Drunk

John Croak’s Victoria Cross

Atlantic Slag Company

Sydney Cement Company

1914 Coal Mine Cost

Dominion No 2

Canary in a Coal Mine

Draegermen

James Dinn

Pit Ponies

Henry Wadsworth Longfellow

1877 Accidents

Allan Shaft 1912

William Fleming

The Story of Peat

T. G. MacKenzie

Trenton Steel

1930 Stats

MacGregor Mine Explosion

MacGregor Flood

Torbanite Products Limited

Abraham Gesner and Kerosene

1860 Prince of Wales Visit

Dominion No 5

The Royal William and Stellarton Coal

Tom Pit

Terminal City

1875 Accidents

Cannons in Coal Mines

Princess Mine Explosion

Dominion No. 26

A Tale of Two Mines

Franklin Colliery

Robert J. Grant

Springhill No. 1

Mother Coo

Submarine Mines

Barrachois Mine

Fundy Coal Seam

Dominion #14

Dominion #12

Dominion No 4

Child Labour

Joggins Colliery

Safety

Bootleggers

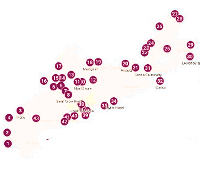

Richmond County

Mabou Mines

Stellar Coal

English Slope

Maccan/Jubilee

The Foster Pit Fire and the Poop Solution

Thomas Edison and the Chignecto coal mine

Henry Whitney and the Dominion Coal Company

Foord Pit

Hiawatha Coal Mine

Coalburn

Springhill Disasters

St. Rose-Chimney Coalfield

Stellarton, Dorrington Softball Complex

How Does Coal Form?

Drummond Coal Mine

Sydney Coalfield and the Princess Mine

Port Morien, 1720

Port Hood

General Mining Association

Thorburn

WWII and Nova Scotia Coal

Nova Scotia's First Railway

Samuel Cunard

Stellarton’s Mining Connections

Sydney Mines

Point Aconi

Victoria Mines

Sullivan Creek

New Campbellton

Inverness and Cabot Links

The Ghost Town of Broughton

Tobin Road, Sydney Mines

Flint Island Coal Mine?!

What does Colliery mean?

Cottam Settlement

Allan Mine

Henry Whitney and the Dominion Coal Company

Cape Breton’s Whitney Pier is named for Henry Melville Whitney, one of the many larger-than-life figures who played key roles in Nova Scotia’s mining and industrial history.

Whitney (1839-1923) was from Conway, Massachusetts, about 130 kilometres west of Boston. He was an entrepreneur and dreamer from a young age. In his 20s, during the American Civil War, he speculated in cotton and concocted a scheme to raise sunken vessels. After his father’s death in 1878, he became president of his father’s most profitable company, the Metropolitan Steamship Company.

In 1886 he formed the West End Land Company in Boston to speculate in land development. He invested heavily, became over-extended and ended up linking the firm to his West End Street Railway Company to try to salvage the situation.

It worked out well. He bought five other street railway systems (horse-drawn public transit) around Boston and, in 1888, began to experiment with electric streetcars to replace the company’s 10,000 horses. His timing with the new electric streetcar technology was excellent and the investment paid off.

This became a pattern for his career – take big risks, interconnect companies he was involved in and fly by the seat of his pants.

Whitney’s steamships and electric street cars relied on coal, so he became interested in Cape Breton’s coal deposits as a potential supplier for his New England companies. In 1893, Whitney established the Dominion Coal Company and consolidated under his ownership practically all the coal mines operating in the Sydney coalfield east of Sydney Harbour: the Gowrie, Ontario, Caledonia, Reserve, International, Glace Bay, Bridgeport and Gardner mines. In 1894, he also took over the New Victoria mine.

(The General Mining Association kept its coal mines on the west side of Sydney Harbour until 1900 when the GMA’s properties in Sydney Mines were bought by the Nova Scotia Steel and Coal Company to supply coal for the steel plant it started building in Sydney Mines in 1902.)

Whitney closed all but three of Dominion’s mines: Caledonia (Dominion #4), Reserve Mines (Dominion #5), and the International (Dominion #8). He believed he needed to focus on running the best mines more efficiently, not continuing to operate all of them. Many of the mines that were shut down had either been in operation a number of years and were largely worked out or were seen as too small to be worth the trouble.

Operating fewer but larger, more efficient mines initially paid off. Dominion invested in equipment and infrastructure at its remaining mines and within ten years, the company had quadrupled its production.

Consolidation of mines also reduced the price wars among coal companies that often ended up hurting all operators. The trend of consolidation in Cape Breton’s coalfields would continue through much of the 1900s.

At the same time, Whitney and the other businessmen behind the Dominion Coal Company were not coal mining experts and they made some extravagant expenditures and costly mistakes. The Victoria mine was closed despite arguably having the best quality coal in Dominion’s portfolio. The Stirling mine, Dominion’s lowest-cost producer, was closed shortly after getting $200,000 worth of equipment installed and an older, less well equipped mine continued to operate at a higher cost. Another mine’s modern $250,000 plant was abandoned.

Perhaps worst of all, Whitney failed to get the American duty on coal eliminated, which hurt the company in the New England market it had been counting on. As a result, Dominion’s stock price dropped and the company scrambled to find other markets for its coal.

It was also suggested that Whitney used Dominion’s coal to boost stock prices in other companies he was involved in. Dominion’s contract with Whitney’s New England Gas and Coke Company guaranteed the New England company coal at below market prices. In 1900 Dominion received an average price of $2.25 per ton when market prices ranged between $3.50 and $4.00.

Whitney also founded the Dominion Iron and Steel Company (DISCO) to build the Sydney steel plant, which entered full production around 1900. An 1899 contract guaranteed that Dominion Coal would supply coal to the steel plant at below market price. An estimate in 1901 suggested almost 90% of Dominion Coal’s production was claimed by low-price contracts.

Steel is mostly made from iron and carbon, and the carbon is derived from coal, so the steel plants in both Sydney and Sydney Mines were built to take advantage of Cape Breton’s coal deposits and iron ore from relatively nearby Bell Island, Newfoundland.

Flux, which is used in the smelting process to promote fluidity and remove impurities in the form of slag, was also easily-sourced from nearby Nova Scotia quarries in places like Point Edward, Marble Mountain and Scotch Lake.

Unfortunately, Whitney and his associates were not steel experts any more than they were coal mining experts, and they made an expensive series of mistakes in building DISCO’s steel plant. For example, a rail mill was partially built and then discarded and replaced by another type. Considerable expense was incurred before they realized realized that the type of coal ore from Dominion’s mines was unsuitable for the Bessemer steel-making process that DISCO planned to use. In the end it was estimated that the steel plant could have been built for only two-thirds of what was actually spent. Seven or eight million dollars were wasted.

Whitney left Cape Breton in the early 1900s and continued to have ups and down in various businesses. One of his daughters later said of him that “He loved to develop things — to take something untried and new and see if he could create a new industry or product. After it was all developed and going, he was not interested any more — it was the creative aspect that he enjoyed. I don't think he was a very good administrator — routine bored him.”

When Whitney died in 1923, the New York Times reported that the estate of “the supposed multi-millionaire” was worth only $1,221.