- Why Mining Matters

- Jobs

- Safety

- Environment & Operations

- FAQ

- Links

- Fun Stuff

You are here

Gallihar and Dimock

Mr. Death

The Guilty Grenos

James Mitchell

Hugh McAskill

Gold Grows Under Shrubs?

Unexploded Dynamite

Tangier’s John Murphy

Joe Howe Dimock

Chats with Pioneer Miners

Charles Annand

John Scott Williams

Nicholas Fitzgerald

Chief Lonecloud

Pistols and Gold Mines

James MacDonald’s Thefts

John Vaughn

Herbert Dixon and the Halifax Explosion

James Bishop

Neily's Scandals

Waverley in 1934

Discovery of Gold at Dufferin

Hurricane Island

Fletcher and Faribault

Jack Munroe

Mine Apprentice Project

Small Gold Districts

15 Mile Stream

Tributers

E. Percy Brown and the Brookfield Mine

Barachois

Nova Rich Mines

Shad Bay Treasure Hunt

Montague 1937 Accident

Father Lanigan’s “Prospect”

George V. Douglas

The Stewart Brothers

Goldboro

Moose River's Touquoy Mine

Camerons Mountain

Jim Campbells Barren

Stanburne's Puzzling Gold Mine

Pockwock

Beaverbank Lake

Banook Mining Company

Deep Gold Mining

Wellington

Arsenic and Gold

Dynamite

War of Words

King of the Klondike

Oliver Millett

Kempt Gold Mining Company

Carleton

The Memramcook Fiasco

Love and Gold in Oldham

Montague 1893 Disaster

Central Rawdon Consolidated Mines

Cochrane Hill

Amateurish Early Gold Mining

Sable Island Gold

The Sea Wolf

Trueman Hirschfield

Alexander Heatherington

Prospector Joe Cope

Killag Quicksand

George W. Stuart

Wellington

Billy Bell

Cooper Jim Mine

South Branch Stewiacke

Walter Prest

Lake Charlotte

Acadia Powder Mills Company

The Ovens Anticline

Moose River Anticline

Avon Mine Explosion

Montague

Waverley Claims Dispute

Avon River

Moose River Disaster

Mooseland Scam

New York and Nova Scotia Gold Mining Company

Rosario Siroy and the South Uniacke Gold District

Blockhouse

Killag Gold District

Miller Lake

Baron Franz von Ellershausen

Mooseland: Nova Scotia’s first Gold Discovery

United Goldfields of Nova Scotia

Pleasant River Barrens Gold District

Lochaber Gold Mining Company

Rawdon Gold Mines

MacLean Brook

Gold in Clayton Park?!

Forest Hill

Meguma vs. Placer Gold

Uniacke

Voglers Cove

Gold River

Moosehead

Goldenville

Westfield

Indian Path

Harrigan Cove

Centre Rawdon

Nova Scotia’s Gold Mining History

WWII Gold

Middle River Gold District

Early Gold Discoveries

Halifax 1867

Paris Exhibition 1867

Mining and Tourism

An Act relating to the Gold Fields

Molega Gold District

Brookfield Gold District

Gays River

Halifax Gold

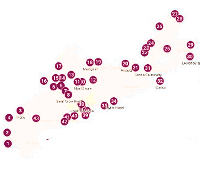

Caribou Gold District

Renfrew Gold District

Oldham Gold District

Whiteburn Gold District

Country Harbour Mines

Waverley Gold District

Robert Henderson and Klondike Gold

George Mercer Dawson

Cow Bay Gold District

Lake Catcha Gold District

Wine Harbour Gold District

Charles Annand

Charles Annand had a wide range of business interests, but his name will forever be linked to a gold mine in Montague that both made him a fortune and indirectly led to his death.

Charles Annand owned the Halifax Chronicle, a newspaper he inherited from his father, William Annand, who was Nova Scotia’s premier from 1867-1875. However, he had little interest in the paper and largely left it to his friend, John Dunn, to manage.

Instead, Charles Annand focussed on various other business interests.

In the 1870s, Annand helped run Muir, Scott & Annand, a large fish and export business. He was also appointed Queen’s Printer for Nova Scotia in 1875.

According to the Halifax Herald’s September 14, 1892, edition, Annand was also “president of the Halifax illuminating and motor company; treasurer of the Halifax’s street railway; one of the Queen hotel syndicate; one of the promoters and a director of the Stewiacke and Landsdowne railway; and was interested in other railway schemes. He was also one of the promoters of the scheme for opening up Ritchie’s woods for building purposes and running a line of electric cars through it.”

He became interested in mining in the 1880s and prospected for coal in Springhill in 1883. He was also a founding investor in the Torbrook Iron Company, which was established in 1891 to look for coal and iron deposits.

He became interested in gold mines and worked in several historical gold districts, including Montague, Waverley, Caribou and Whiteburn.

His most successful gold mining venture was in Montague, Halifax County, where he took over the New Albion mine in 1889. The mine had closed four years earlier despite having a very successful year in 1885. The New Albion Gold Mining Company struck a very rich zone in September that year, which produced 1,369 ounces of gold from just 337 tons of quartz, an average of four ounces per ton. Historical gold mines often produced about one ounce, or less, of gold per ton of ore, so this was a terrific result.

However, gold is virtually never distributed evenly throughout a deposit. There will inevitably be richer and poorer areas. Albion encountered lower-grade quartz after this highly profitable pocket, and the mine shut down by the end of the year.

It was common in Nova Scotia’s historical gold mines that poor business decisions led to mines closing even though there were still economically-viable quantities of gold in the deposits. For example, many companies that struck pockets of rich ore, as Albion did, paid the profits to their investors, and did not maintain enough cash reserves to get them through the periods of mining lower-grade ore that inevitably followed.

This is an example of why we say in the mining industry that new mines are often found next to old mines. Historical miners discovered a resource but the obstacles they faced in the 1800s and early 1900s – such as lack of funds and basic infrastructure, insufficient mining expertise, and primitive science and technology – often prevented them from fully extracting it. Historical mines often have the potential to be mined profitably and environmentally-responsibly with modern science and engineering, and most of the activity in Nova Scotia’s gold sector is in historical mining districts.

There was little mining in Montague from 1886-88, but Annand revived the district by reopening the Albion mine in 1889. The Department of Mines annual report for that year said, “The Annand Mine yielded large returns and some remarkably rich ore.”

Annand had another good year in 1890 when the mine produced 362 ounces from 120 tons of crushed ore, an average rate of three ounces per ton.

The Annand mine became known for its pockets of rich ore that often contained large nuggets of gold. The Halifax Herald described it as “the famous nugget mine at Montague.” The Canadian Mining Review said in 1893 that the mine “is known far beyond the boundaries of Nova Scotia for its magnificent nuggets and specimens from time to time.”

The November 16, 1895, edition of the Evening Mail said, “The Annand Mine a few years ago was a wonder to see, on account of the nuggets taken out of it.”

Given the mine’s reputation, it is not surprising that by 1892 Annand was closing a deal to sell it and several other gold properties to an English syndicate for a reported $100,000.

Annand went to London, England, in June that year to finalize the deal. After signing the agreement, he caught pneumonia and went to Lowestoft, an English coastal town, to recover. Feeling better, he returned to London en route to coming home to Halifax. However, he had a relapse in London and died suddenly at the home of his sister.

The September 14 edition of the Halifax Herald said, “He was one of the last men in the city of whose death the public might expect to hear. And he was one of the few hustling enterprising men that Halifax can ill afford to lose.”

The newspaper described him as “Apparently reserved, haughty and unapproachable in his manner, to those who knew him thoroughly, he was kind, generous to a fault, and a faithful friend. His death, while in the prime of his life – 52 years of age – will be sincerely regretted and deeply felt.”