- Why Mining Matters

- Jobs

- Safety

- Environment & Operations

- FAQ

- Links

- Fun Stuff

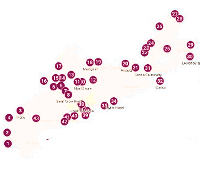

You are here

Gallihar and Dimock

Mr. Death

The Guilty Grenos

James Mitchell

Hugh McAskill

Gold Grows Under Shrubs?

Unexploded Dynamite

Tangier’s John Murphy

Joe Howe Dimock

Chats with Pioneer Miners

Charles Annand

John Scott Williams

Nicholas Fitzgerald

Chief Lonecloud

Pistols and Gold Mines

James MacDonald’s Thefts

John Vaughn

Herbert Dixon and the Halifax Explosion

James Bishop

Neily's Scandals

Waverley in 1934

Discovery of Gold at Dufferin

Hurricane Island

Fletcher and Faribault

Jack Munroe

Mine Apprentice Project

Small Gold Districts

15 Mile Stream

Tributers

E. Percy Brown and the Brookfield Mine

Barachois

Nova Rich Mines

Shad Bay Treasure Hunt

Montague 1937 Accident

Father Lanigan’s “Prospect”

George V. Douglas

The Stewart Brothers

Goldboro

Moose River's Touquoy Mine

Camerons Mountain

Jim Campbells Barren

Stanburne's Puzzling Gold Mine

Pockwock

Beaverbank Lake

Banook Mining Company

Deep Gold Mining

Wellington

Arsenic and Gold

Dynamite

War of Words

King of the Klondike

Oliver Millett

Kempt Gold Mining Company

Carleton

The Memramcook Fiasco

Love and Gold in Oldham

Montague 1893 Disaster

Central Rawdon Consolidated Mines

Cochrane Hill

Amateurish Early Gold Mining

Sable Island Gold

The Sea Wolf

Trueman Hirschfield

Alexander Heatherington

Prospector Joe Cope

Killag Quicksand

George W. Stuart

Wellington

Billy Bell

Cooper Jim Mine

South Branch Stewiacke

Walter Prest

Lake Charlotte

Acadia Powder Mills Company

The Ovens Anticline

Moose River Anticline

Avon Mine Explosion

Montague

Waverley Claims Dispute

Avon River

Moose River Disaster

Mooseland Scam

New York and Nova Scotia Gold Mining Company

Rosario Siroy and the South Uniacke Gold District

Blockhouse

Killag Gold District

Miller Lake

Baron Franz von Ellershausen

Mooseland: Nova Scotia’s first Gold Discovery

United Goldfields of Nova Scotia

Pleasant River Barrens Gold District

Lochaber Gold Mining Company

Rawdon Gold Mines

MacLean Brook

Gold in Clayton Park?!

Forest Hill

Meguma vs. Placer Gold

Uniacke

Voglers Cove

Gold River

Moosehead

Goldenville

Westfield

Indian Path

Harrigan Cove

Centre Rawdon

Nova Scotia’s Gold Mining History

WWII Gold

Middle River Gold District

Early Gold Discoveries

Halifax 1867

Paris Exhibition 1867

Mining and Tourism

An Act relating to the Gold Fields

Molega Gold District

Brookfield Gold District

Gays River

Halifax Gold

Caribou Gold District

Renfrew Gold District

Oldham Gold District

Whiteburn Gold District

Country Harbour Mines

Waverley Gold District

Robert Henderson and Klondike Gold

George Mercer Dawson

Cow Bay Gold District

Lake Catcha Gold District

Wine Harbour Gold District

New York and Nova Scotia Gold Mining Company

In 1865, a court in New York State heard a case that was just a small part of the remarkable story of the New York and Nova Scotia Gold Mining Company, but a hint of the company’s larger problems.

Lemuel Sisson was an early investor in the New York and Nova Scotia Gold Mining Company (NYNSGMC), which worked in Tangier, Halifax County, in the early 1860s, during Nova Scotia’s first gold rush. In 1863, he owned 10,000 shares of the company’s stock. As a significant investor, the company employed him as an officer, and he was living in Tangier.

Sisson claimed that in November 1863, Benjamim C. Buzby, president of NYNSGMC, told Sisson that the company’s stock “had scarcely any value, and that the quotations of it in Wall-street were merely nominal,” according to the New York Times.

Sisson, based in rural Nova Scotia in an era before mass communications, could not easily check on the stock’s value so he agreed to Buzby’s offer to buy Sisson’s stock at fifty cents a share. Sisson returned to New York soon after and discovered that the market value of the stock was between two and three dollars per share, and that it subsequently rose much higher.

Sisson sued to recover $35,000 (about $620,000 today) he claimed he was cheated out of. The case, which went to trial in December 1865, was against John Buzby, executor of Benjamim Buzby’s estate, Benjamin then being deceased.

Buzby’s defence was that Sisson, as an officer of the company who worked at the mine, was “intimately acquainted with the value of the mines, the manner in which they were worked, and the amount of gold obtained from them,” according to the Times. The defence denied that Benjamim Buzby had made false claims about the company’s stock, but even if he had, Sisson should not have believed him given his own knowledge of the company – “that, as a matter of law, he had no right to shut his eyes, make a foolish bargain, and then come into a court of justice for relief.”

Justice Barnard, the presiding judge, seemed sympathetic to Buzby’s position. In instructing the jury, he said it was a well-settled maxim in law that "no man can take advantage of his own wrong." Barnard told the jury that to win his case, Sisson had to prove that he was the owner of the shares in question; that he sold them at a lower price than they were intrinsically worth; that he made the sale to Buzby because of what Buzby allegedly told Sisson; that Buzby’s comments about the stock’s value were false and calculated to deceive; and that Sisson did not have as good an opportunity to know the value of the stock as Buzby had.

Sisson was not the only person who had complaints about NYNSGMC at that time. Articles in December 1864 in the New York Stockholder and February 1865 in Mining and Smelting Magazine both raised serious concerns about the company. Stockholders were complaining that they bought stock at prices between $3 and $5 but the stock’s value was then so low that “they can not now get rid of the stock at any price.”

The publications said, “The stock of the Company has been extraordinarily puffed, and so skillfully manipulated, that every stockholder believed himself rich, after having purchased it at the rate of $5 per share; and rich dividends and regular returns from the mines were expected, when the bubble burst, to the utter astonishment of everybody, except those initiated into the real condition of the Company’s affairs.”

The Stockholder said it had warned readers 18 months earlier that even if the company’s claims about its production were not exaggerated, “the capital stock was so large, the price of shares were selling so high, that very moderate dividends, at best, could be expected.”

The publications claimed the company was about $36,000 in debt. “It appears that out of a capital of $1,000,000, a paltry sum of $25,000 only has been employed for the benefit of the enterprise…The New York and Nova Scotia Gold Mining Company was, from the beginning, a stock-jobbing concern, and nothing else….”

So, what had the company done to deserve such harsh criticism?

Captain Peter Mason, a fisherman, was the first to discover gold in Tangier in October 1860, in a brook north of Rush Lake, while he was watering his ox.

By 1862, twelve gold-bearing veins were being worked simultaneously, the richest being the South, Leary and a vein named for the “N-word.” (We do not use the actual name because it is inappropriate.) The “N-word” vein produced the largest nuggets, some reported to be over 20 ounces each.

In 1863, most of the staked claims were abandoned by their owners, who were mostly individuals with little mining knowledge but dreams of getting rich. Their dreams dashed, most went back to their farms, fishing boats and other occupations, and their claims were acquired by mining companies, the largest of which was the New York and Nova Scotia Mining Company. These companies could afford newer and more sophisticated equipment and were, in theory, better able to take advantage of the area’s mineral potential.

In 1864, Benjamin Silliman, Professor of Chemistry at Yale College, visited Tangier to see the NYNSGMC property and offer an analysis. He concluded that “This is undoubtedly, at the present time, the best development gold property in the Province of Nova Scotia. It was to this spot that the great crowd of gold hunters rushed in 1861-62; vainly hoping to enrich themselves by unorganized and unsystematic labor. While a few were fortunate, the chief benefit of their ill-directed labor was the discovery and exposure of a large number of gold-bearing veins, now consolidated in the organization of this Company.”

In fact, it was believed at that time that there were about 30 gold-bearing quartz veins on the company’s property. Eleven had been uncovered and two were being worked.

Silliman wrote that the company had built a 24-stamp mill to crush the ore, and installed a steam engine, boilers and various other equipment for mining and milling. The company had also dug a 130-metre adit (tunnel) into a hill, starting near Rush Lake. A tramway had been installed to carry ore from the adit to the mill.

Despite the mine’s tremendous potential, by 1866 the New York and Nova Scotia Gold Mining Company’s stock had collapsed and the company was trying to sell the mine.

Professor Minos C. Vincent, a Fellow of the Geological Society of London, visited it at the request of Andrew Barton to assess the mine’s value. Barton, who mined in Tangier for two decades and also worked in the Mooseland gold district in 1868, was apparently considering buying the mine.

Like Silliman, Vincent wrote, “This may be said to constitute one of the most valuable gold-mining properties in Nova Scotia.”

His assessment was based at least partly on the success of neighbouring mines where the same veins were being worked. For example, he said the Little South Lode “is almost untouched on the New York and Nova Scotia Company’s possessions” but “it has proved, by an extensive development on the contiguous property, to be a vein of remarkable richness. Three recent crushings of quartz at the Tangier Company’s Mill, averaged nearly six ounces of coarse gold to the ton…This deposit, in the operations of the Tangier Company, has been thoroughly tested to the depth of one hundred feet. It is uniformly good, and unquestionably one of the most valuable lodes in the Province.”

Similarly, the Kent Lode “is almost wholly undisturbed within the Company’s lines, but on the neighbouring property it has been worked, and ascertained to yield a remunerative amount of gold.”

The Ferguson Lode had been “opened and worked with good returns on the adjoining property….”

The number of gold-bearing veins (aka lodes) on the property represented tremendous potential, and it was a positive sign that nearby mines were achieving success. However, NYNSGMC needed to actually get gold out of the ground and generate revenue.

NYNSGMC was no longer operating by the time of Professor Vincent’s 1866 visit and “a heavy accumulation of surface water had so encumbered the underground workings as to render a close inspection impossible…The present, or rather past Company, have expended their inadequate capital in erecting excellent dressing works, Manager’s residence, stables, sinking shafts, blasting adit, etc., etc. In a word they have exhausted their means in putting the property in such a state of preparation that the purchaser of the same at this time, might commence with only a limited further outlay, to realize the most gratifying results.”

In his report about the property, Silliman stressed the importance of doing ongoing exploration and warned against focussing solely on extraction to please shareholders with quick profits: “The desire for early returns to stockholders often leads to a short-sighted system of hand-to-mouth administration, the result of which is uniformly fatal. The mine is robbed to secure a specious show of dividends, and then follows an unproductive period, in which the manager finds an empty treasury and no power of new calls on the owners, or a reluctant response, ending soon in the abandonment of the enterprise. Such is sure to be the case whenever works of exploration are suspended.”

Silliman was talking about mining companies in general, but his advice certainly applied to NYNSGMC, which had access to many veins on its property but did little to advance most of them, instead focussing on extraction at just two.

It is not clear whether the company “puffed” and “manipulated” its stock price, as the media coverage argued, or if its management was simply incompetent. The company certainly invested significant sums in machinery and equipment and had dug an important tunnel between 1863 and 1864.

It was common in the historical era for Nova Scotia’s gold mining companies to have problems that had nothing to do with their mines’ mineral potential. Rather, companies often fell apart due to issues such as lack of capital and mining expertise, the rudimentary science of the day, and poor management. Even Mining and Smelting Magazine acknowledged that the failure of companies like NYNSGMC was due “in many instances at least, to be attributable rather to the character of those connected with the schemes brought forward, than to an absence of intrinsically valuable mineral resources.”

This is partly why we say that new mines are often found next to old mines. The historical activity tells us there is a resource there. However, obstacles faced by Nova Scotian gold miners in the 1800s and early 1900s often prevented them from extracting it. Today, historical sites like Tangier have the potential to be mined profitably and environmentally-responsibly with modern science and engineering.

The New York and Nova Scotia Gold Mining Company’s property was purchased in 1869 by H. R. Fletcher of the Burlington Gold Mining Company, which worked it for several years.

Lemuel Sisson lost the trial, which is not surprising given that the judge’s instructions to the jury made it very unlikely that he could prove his case. However, since the company’s stock was basically valueless by the end of 1864, it is possible that he was better off having sold it for 50 cents per share in 1863 than if he had held onto it.

Learn more about the Tangier gold district at https://notyourgrandfathersmining.ca/tangier